The Crypto End-Game

Bankruptcy administration proves fraught: assets and destinies in the hands of judges and trustees... some of whom can prove adversarial or susceptible to "influence"...

If at all possible, when a company or investment vehicle proves distressed, the creditors seek to work it out, amongst themselves: hence the expression "loan workout".

LTCM & the Broken Arbitrage

Long Term Capital Management failed because its GKO Russian bond investments had a "faulty hedge": Ruble currency hedges that were offered by defunct mafia-controlled Russian banks (e.g. Alfa Bank).

LTCM publicly claims that it was broad-sided by the Russian banks failure to execute the Ruble hedges that were priced to protect the downside risk in the value of its GKO bonds: if the Ruble FX hedge worked as expected, then a decline in the GKO bond prices would not have resulted in a collateral call for the entire LTCM firm, which resulted in a bail-out call across Wall Street.

(NB: this period of the late 1990's was the "final push" for an attempt to de-Nuclearize Russia with offers of a bailout - in particular, from the EU and from the Doves in the US. It seems quite unlikely that sophisticated traders would assume an obviously mafia-owned bank would deliver on FX hedges in a crisis, but one can only speculate if LTCM truly "failed" or acted for a "greater purpose".)

Crypto Credit & FX Hedges

With the institutional adoption of stablecoins, we now see credit issued in crypto-based currencies: crypto speculators now park their money either in bank-issued stablecoins or centralized exchanges hosted in the United States.

If, however, one uses crypto as collateral for a loan, then what happens, if the underlying loan goes bad? Normally, the default proceeds along the chain of seniority with respect to lien, with super/senior in first position, sub in second position, et cetera.

Is a "Senior Crypto Loan" still "Senior", if Crypto Crashes?

Where things can come apart is in the underlying FX risk implied by crypto: unlike national currencies, which maybe "shock" with a high single-digit to low-double digit move (e.g. IMF reform, UK exit ERM, Trump "tariffs", et cetera), Crypto can EASILY dislocate - completely - and break risk models.

Assuming a borrower defaults and the creditors agree to a moratorium to execute a loan workout, if the crypto FX goes catastrophically against the underlying currency of the other main creditors, guess what: effectively, the crypto lender LOSES COMPLETE SENIORITY IN THE WORKOUT.

"Six-Sigma Downside Move" in Crypto Subordinates Senior Crypto Credit

In a loan workout, the crypto creditors risk facing subordination despite legally being pari-passu with other less/non-volatile credits in the same tranche. The crypto creditors could very well find themselves subject to absorbing losses of their underlying FX (BTC/USD) during the loan workout moratorium.

Crypto Volatility - Backdoor Debtor Bailout

Thus, the underlying crypto market volatility and autocorrelation across crypto assets can lead to a once-in-a-generation wealth transfer from crypto creditors to borrowers.

However, this commercial loan example pales compared to the Trump administration clever "safe-haven harvesting" executed by the stablecoin issuers.

Stablecoins - Short Crypto; Long Bank Reserves - By Design

Savvy players already articulated why stablecoins exist and how they synthesize outsized demand for US Treasury bills - what few publicly discuss is what happens when:

- US Treasury stops issuing Treasury bills for financing, moving to either Tariff inflows or long-term bonds/notes

and - A crypto-crash creates a "rush for bank reserves" in the stablecoin industry

Stablecoins allow the US banking system to "wind the demand spring" for reserve banking reserve collateral, as a failure in the crypto market, engineered or just "assisted", results in a massively skewed INCREASE in demand for bank reserves by stablecoin funds.

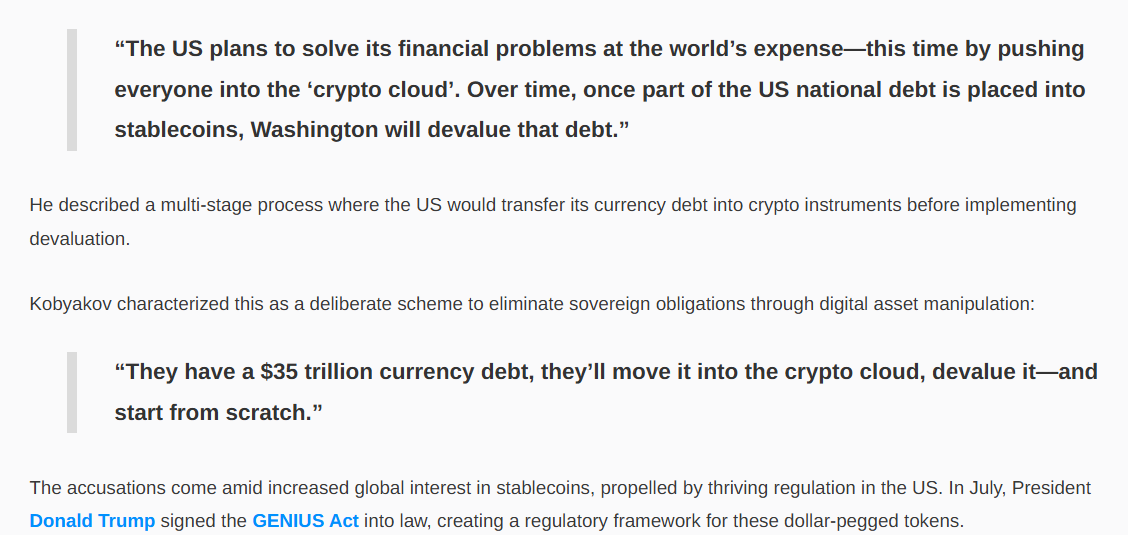

Who else articulates the above plan? Why, none other than one of Putin's advisors, who publicly denounced the Trump administration's harvesting of the crypto "safe haven" flow:

Dmitry Kobyakov precisely articulated the long-term scheme with stablecoins, as the crypto market, hosted and controlled within the USA, remains completely under American control and would find itself "squeezed" to eliminate a reasonable portion of America's burdensome debt.

Trump Admin - Front-Running Safe Haven Trades to Recapitalize America

Having seemingly corralled the crypto safe-haven onto US shores, Trump only needs to regain control of the gold market, and for this, he must take control of the Latin, South American, and sub-sea gold reserves to provide America the necessary gold surplus to dominate this market against China.

Thus, expect to see continued "regime change" in the southern Western hemisphere, alongside efforts to expand subsea mineral exploitation to capture the rich gold veins heretofore blocked from exploitation by the multilateral UNCLOS.